The Agricultural Development Bank (ADB) has been plunged into turmoil following the abrupt dismissal of several senior managers and department heads, widely regarded by staff as seasoned professionals.

These terminations, described as shocking and unexplained, have sparked unrest within the bank.

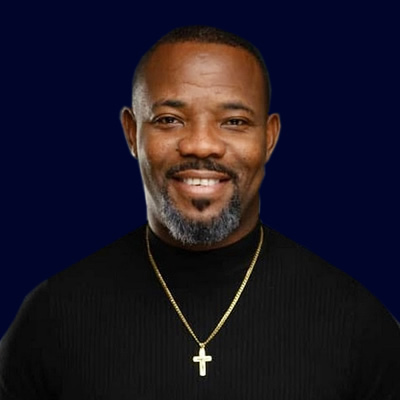

Sources suggest that the Deputy Managing Director (DMD), Eno Ofori-Atta, orchestrated these dismissals, allegedly driven by personal motives and fears of exposure over questionable transactions. Some staff speculate that the actions also served to bolster her authority within the institution.

The terminations were executed shortly after Ghana’s December 7, 2024, general elections, with those affected including Chief Compliance Officer Da Costa Owusu Doudu, Deputy Chief Audit Executive Ahmed Osman, Head of Collateral and Documentation Michael Agyei Baah, and Due Diligence Officer Paul Fynn.

Adding to the controversy, the termination notices were disseminated to staff within three days of issuance—departing from the customary practice of waiting until the end of the month or quarter.

The terminations were also labelled explicitly as such, eschewing the more neutral term “exits,” in what staff perceive as a deliberate move to tarnish the reputations of those dismissed.

Reports indicate that the affected individuals are deeply distressed, not only by the manner of their dismissal but also by the absence of reasons provided.

This lack of transparency has fueled speculation among staff, casting a shadow on the credibility of the dismissed managers and creating further unrest within the institution.

Allegations of Personal Vendettas and Power Struggles

Observers and insiders question whether these dismissals stem from personal vendettas, particularly on the part of the DMD. Eno Ofori-Atta has faced accusations of abusing her position, with claims that her actions are driven by ego and political backing rather than professional judgment.

Sources allege that Ofori-Atta, married to a relative of Finance Minister Ken Ofori-Atta, wields significant influence within the bank, often overshadowing the authority of the Managing Director.

At a recent Executive Committee meeting on the bank’s Non-Performing Loans, Ofori-Atta allegedly berated senior staff, including a seasoned lawyer heading the Credit Administration Department, whom she insulted in front of colleagues.

The tension escalated when another manager, frustrated by her conduct, retaliated against her accusations, which reportedly led to his dismissal.

Insiders claim that Ofori-Atta manipulated internal processes to target certain staff, particularly those in the Risk Division. Former Chief Risk Officer (CRO) Da Costa Owusu Doudu and the Head of Credit Risk faced ongoing hostility, culminating in the CRO’s transfer to the Compliance Department—a move widely seen as punitive.

Attempts by the Head of Credit Risk to avoid conflict reportedly did little to deter Ofori-Atta’s antagonism, as she repeatedly undermined him and obstructed his career progression.

Unanswered Questions and Lingering Tensions

The motivations behind these terminations remain unclear, fueling further speculation about the bank’s internal politics.

Is the Board complicit in these actions, or is it attempting to distance itself from regulatory scrutiny by scapegoating certain managers?

While Ofori-Atta appears to have consolidated her authority, these developments have raised concerns about the impact on staff morale, institutional credibility, and the broader health of Ghana’s financial sector.

For now, the unanswered questions leave staff and stakeholders waiting anxiously for clarity as tensions continue to rise.

Stay tuned for further updates on this unfolding story.