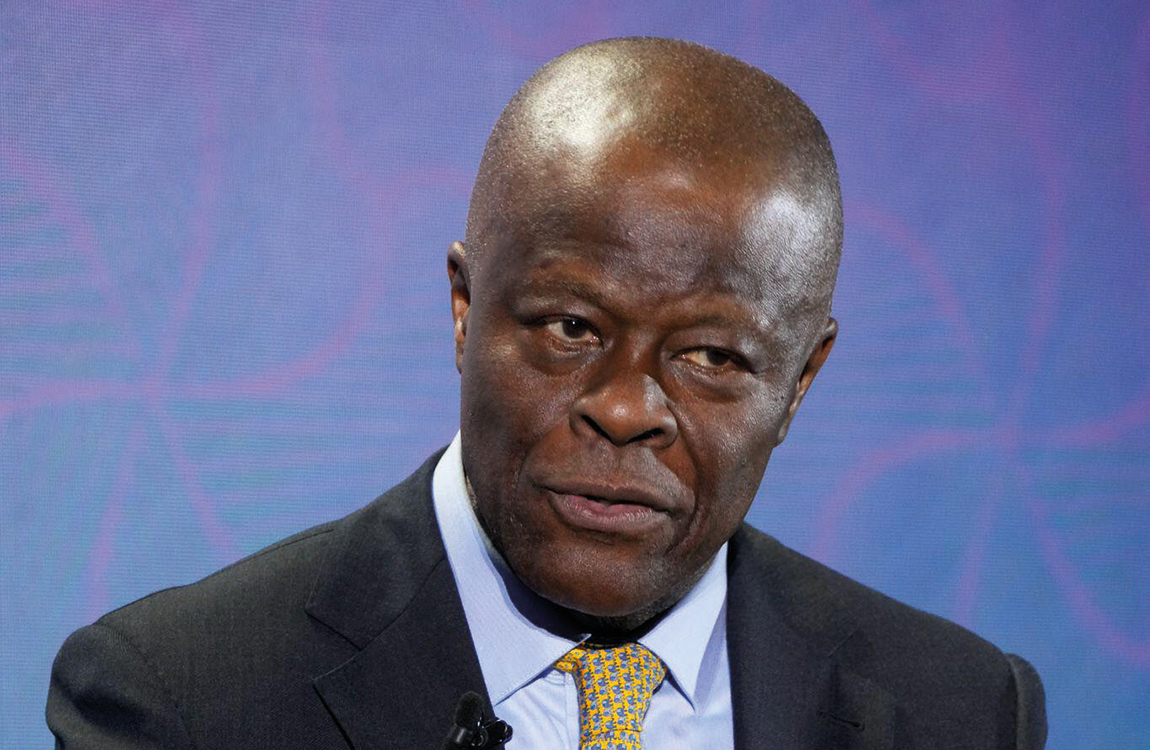

When President Bola Tinubu appointed Olawale Edun as Nigeria’s finance minister and coordinating minister of the economy in August 2023, many analysts wondered how he, alongside his colleagues in the fiscal and monetary authorities, would rejig an economy on the edge of total collapse.

A few months before the appointment was announced, Tinubu had just won a brutally disputed February 2023 presidential election, which was being challenged by his main opponents in court at the time. Vice President Atiku Abubakar, candidate of the People’s Democratic Party (PDP) and Peter Obi, the candidate of the Labour Party, both came second and third in the keenly contested elections. Both men claimed that the elections were rigged, and that Tinubu should be so removed from office.

Although Tinubu’s elections would later be confirmed by the election tribunals and the Supreme Court, the administration at the time faced serious legitimacy issues.

In that sense, among market analysts and economic experts, Wale Edun’s job was considered near-impossible.

It is important to state clearly that the scepticism that trailed his appointment didn’t stem from any doubt about Wale Edun’s expertise and competence to drive the reform; far from it!

In fact, he came very prepared for the job, as results of the past few months have shown.

Olawale Edun has a background in merchant banking, corporate finance, economics and international finance at both national and international levels. He is a former Chair of ChapelHillDenham Group, Lagos, a leading investment bank. He was an executive director of Lagos merchant bank, Investment Banking & Trust Company Limited, now Stanbic IBTC. He is also the Chair of Livewell Initiative, a not for profit organisation that specialises in health literacy advocacy and practical training in Nigeria, and a Trustee of Sisters Unite for Children, a not for profit institution that focuses on helping street children in Lagos.

But there were just too many hurdles for the President Bola Tinubu government to cross at the time, amid poor fiscal position, widespread poverty, dwindling revenues and drifting economy.

At the time of Edun’s appointment, Nigeria’s inflation rose to an 18-year high in July 2023. The country also faced widespread insecurity, mounting debt burden, high unemployment and slow growth which stoked tension among the population already struggling with a high cost of living.

To rejig the economy, Tinubu decided to embark on some of the boldest reforms that Nigeria has seen in years, including scrapping a popular but costly petrol subsidy and removing exchange rate restrictions.

Consequently, the naira weakened to record lows amid sky-high inflation and poverty.

Gains of Reforms

But in recent months, the pains witnessed by Nigerians seem to be paying off gradually as the gains of reforms are now manifesting.

Nothing demonstrates the confidence being restored in the local economy like how Nigeria recently achieved a milestone with its first-ever domestic dollar bond, which was oversubscribed by 180%.

Initially aiming to raise $500 million, the government finally secured $900 million in commitments. This result surprised many, given Nigeria’s fragile economic situation.

Wale Edun described the bond as a landmark for the country’s domestic market, adding that this success demonstrates investors’ confidence in the country’s ability to turn the economy around.

The bond, with a 9.75% coupon paid semi-annually over five years (an effective rate of 9.99%), is aimed at financing strategic projects in key sectors such as energy and infrastructure. The bond is part of a broader $2 billion program registered with Nigeria’s Securities and Exchange Commission. According to the terms of the issuance, the government has the option to absorb additional subscriptions up to the program’s full $2 billion limit.

The 180% oversubscription was indeed a major victory, drawing interest from Nigerian investors, the diaspora, and international institutions.

But before then, there has equally been some gains in the economy, all pointing towards Edun—-and indeed Tinubu’s—-rejig of the economy.

Already, the Federal Government no longer depends on the Central Bank of Nigeria (CBN) to fund its emerging obligations,a major part of the fruits being yielded by ongoing efforts to improve efficiency and ramp up revenues.

In September, Edun said the government has exited the use of Ways and Means advances for meeting emerging financing obligations, a practice that had been rampant until recently.

Within the periods, the federal government through the Central Bank of Nigeria cleared all outstanding matured and verified FX backlogs totaling $6 billion owed to various creditors, including foreign airlines.

All of the payments were without any depletion in the nation’s foreign reserves. Rather, the reserves have risen to a high of $41 billion, even as the nation remains at a far better fiscal position than it was before the new government came in, now meeting its obligations to creditors without hassles.

In recent months, it has become equally obvious that government was working to plug all loopholes and optimise Nigeria’s financial potential by ensuring that the country’s sovereign assets are fully harnessed for growth and development. Nigeria has huge stranded assets, which the government is expected to unlock to boost its financing liquidity, and efforts are being directed towards this path in recent months.

Another major gain of the government’s macroeconomic reforms is that the country now records a monthly net inflow of about $2.35 billion into its foreign exchange (forex) reserves in the recent months, an inrease that has contributed significantly to the stability of the naira in the forex market. Consequently, between Monday and today, Wednesday, the Naira has gained over N140 in the parallel market while strengthening and stabilizing in the orthodox market.

One equally important development that demonstrates the efficacy of Edun’s managerial competence was evident in the recent endorsement of the economic reforms by the International Monetary Fund. In her engagement with President Tinubu in November, the Managing Director of the International Monetary Fund, Kristalina Georgieva, commended Nigeria’s economic reforms under the leadership of Tinubu.

The IMF chief highlighted the progress made by Nigeria in its quest for economic stability and assured that the IMF remains strongly committed to supporting Nigeria on its path to recovery and sustained development.

What all of these have shown is that while reforms championed by Edun, Cardoso and others can be painful and tortuous, the gains can only reset a collapsing economy and fix a better future for younger Nigerians.

Like Georgieva said, the reform will surely “accelerate growth and generate jobs for its (Nigeria’s) vibrant population.” Surely, Wale Edun and others deserve all the support they can get.